Welcome to Our Latest Elliott Wave Analysis for Exxon Mobil Inc. (XOM)

This analysis dives deep into the price movements of Exxon Mobil Inc. (XOM) using Elliott Wave Theory. Our goal is to help traders spot potential opportunities based on current trends and market structures. We will examine insights from both the daily and 4-hour charts to provide a thorough perspective on XOM's market behavior.

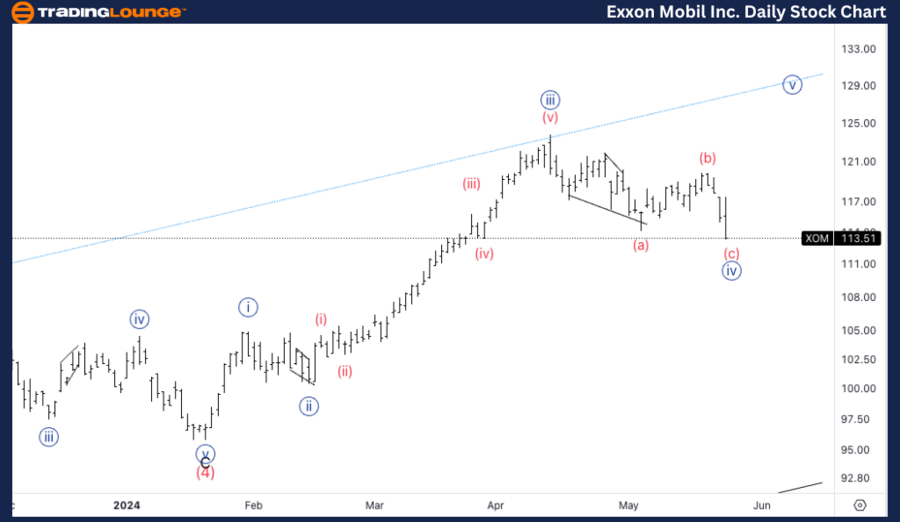

XOM Elliott Wave Analysis Trading Lounge Daily Chart,

Exxon Mobil Inc. (XOM) Daily Chart Analysis

XOM Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: ZigZag

Position: Wave {iv} of 1

Direction: Bottom in wave {iv}

Details: XOM is correcting deeper than anticipated in wave {iv}, but a potential upward turn is possible as we approach the $110 mark.

On the daily chart, XOM is in a corrective phase, specifically a ZigZag pattern. This pattern is part of wave {iv} of 1, indicating a counter-trend movement. The correction is deeper than initially expected, but signs point to a possible reversal as we near $110. This level is crucial for traders to watch, as it may signal the end of the corrective phase and the beginning of a new upward trend

XOM Elliott Wave Analysis Trading Lounge 4H Chart,

Exxon Mobil Inc. (XOM) 4H Chart Analysis

XOM Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: ZigZag

Position: Wave (c) of {ii}

Direction: Bottom in wave (c)

Details: XOM is at 0.618 (c) vs. (a). We anticipate a turn soon, with the next target being the equality of (c) vs. (a) at $110.

The 4-hour chart provides a more granular view of XOM's price movements. Here, we observe a ZigZag pattern in wave (c) of {ii}. The price is currently at 0.618 (c) vs. (a), a critical Fibonacci retracement level. This suggests a potential turning point soon, with the next target being the equality of (c) vs. (a) at $110

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: NVIDIA Corp. (NVDA) Stocks Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support